Why Global Wealth Is Concentrating in Brickell and Downtown Miami

Why Global Wealth Is Concentrating in Brickell and Downtown Miami

Global investors are not approaching Miami as a single, uniform market.

Capital is becoming increasingly selective — and today, Brickell and Downtown Miami sit at the center of that concentration.

While ultra-luxury enclaves like Fisher Island and Sunny Isles remain important, the data shows that Brickell and Downtown now function as Miami’s core global urban districts, attracting both lifestyle buyers and long-term capital.

Miami’s Global Standing as an Investment City

Recent market data highlights Miami’s position among global real estate destinations:

• #1 worldwide destination for ultra-wealthy second-home buyers

• 52% of new construction sales went to foreign buyers in the past 22 months

• 4th globally for ultra-wealthy residents

• #1 U.S. city for second-home ownership among ultra-wealthy buyers

• 8–9% of all U.S. international home-buying interest is concentrated in Miami

What has changed is where that demand is being deployed.

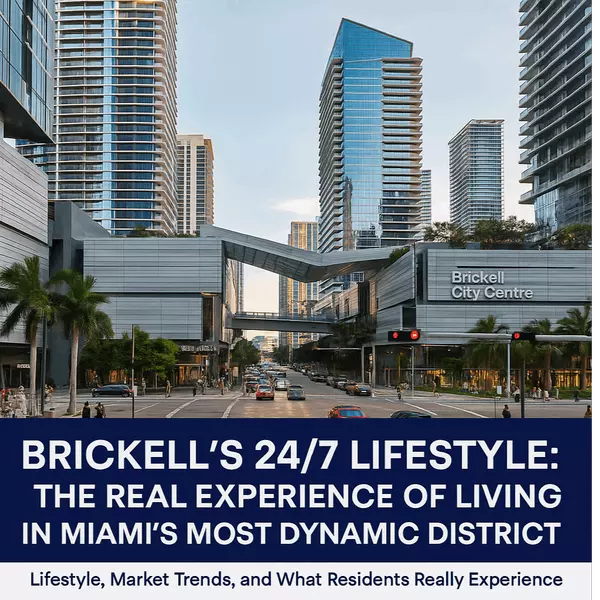

Brickell and Downtown: Miami’s Global Urban Core

Brickell and Downtown now represent Miami’s closest equivalent to a global CBD.

They combine:

• High-density residential towers

• Financial institutions and corporate offices

• Walkability and transit connectivity

• New construction inventory suitable for international buyers

• Strong rental demand and liquidity

This combination is why global capital increasingly prioritizes these two neighborhoods over purely lifestyle-driven submarkets.

Price Per Square Foot: Why Brickell and Downtown Stand Out (Q3 2025)

Comparative pricing reinforces the shift.

• Brickell: ~$884–$1,200 per sq ft

Urban sophistication, walkability, consistent rental demand

• Downtown Miami: ~$710–$720 per sq ft

Emerging pricing, improving inventory quality, upside potential

For comparison:

• Sunny Isles Beach: ~$1,200–$1,300 per sq ft (beachfront, international lifestyle demand)

• Fisher Island: ~$2,700+ per sq ft (trophy assets, extreme scarcity)

Key takeaway: Brickell and Downtown offer global-city characteristics at pricing levels that still allow entry and scale, unlike fully priced trophy markets.

How Global Buyers Are Segmenting Miami

Today’s international buyers are highly strategic.

• Brickell:

Primary choice for buyers seeking walkability, rental income, and long-term urban relevance

• Downtown Miami:

Value-oriented investors targeting early-stage appreciation and improving fundamentals

• Fisher Island:

Capital preservation, privacy, and scarcity

• Sunny Isles Beach & Coconut Grove:

Lifestyle-driven purchases with strong international appeal

This segmentation strengthens Miami’s overall market by diversifying demand rather than concentrating risk.

International Buyer Fundamentals Favor Brickell and Downtown Miami

Brickell and Downtown are particularly attractive to foreign buyers due to:

• Availability of financing at 60–70% LTV

• Condominium-heavy inventory that simplifies ownership

• Strong rental absorption

• Easier management for international owners

Additional considerations:

• FIRPTA withholding: 15% of gross sale price upon exit

• Common use of LLC structures for liability and tax planning

• Newer construction often benefits from lower insurance premiums

Real Estate and Immigration: Why Urban Condos Matter

Immigration-linked investment programs often favor urban, income-producing assets.

• E-2 Treaty Investor Visa:

Typically $100K–$250K+ tied to operating businesses

• EB-5 Green Card Path:

$800K–$1.05M+ investments, often connected to real estate development

Brickell and Downtown projects frequently align with these requirements due to scale, employment creation, and financing structures.

Florida’s Tax Advantage Amplifies Urban Demand

Florida’s zero state income tax disproportionately benefits high-earning professionals and international investors.

On ~$10M annual income:

• Florida: $0

• California: ~$1.1M+

• New York State + NYC: ~$1.3M–$1.5M+

When combined with walkability, global connectivity, and legal stability, Brickell and Downtown become logical anchors for relocated capital.

Market Outlook: 2025–2026

Looking ahead:

2025:

• Buyer-friendly conditions

• Higher inventory

• Increased negotiation leverage

2026:

• Potential rate cuts

• Continued wealth migration

• Sustained demand for prime urban assets

Brickell and Downtown are expected to absorb the majority of institutional and international demand, while trophy and lifestyle markets remain selective plays.

Bottom Line

Miami’s evolution is no longer theoretical. It is structural — and Brickell and Downtown sit at the center of it.

While Fisher Island, Sunny Isles, and Coral Gables and othes continue to serve specific buyer profiles, Brickell and Downtown now represent Miami’s long-term global urban bet.

📍 Looking for your next Miami property?

Contact Miami Realty Solution Group today at 📞 786-361-7289 or visit MiamiRealtySolution.com to explore the latest opportunities in Brickell, Downtown, Edgewater, Miami Beach, Surfside, and beyond.

Categories

Recent Posts

GET MORE INFORMATION